It’s in the news every year at tax time – Social Security needs reform or it will run out of money in 13 years. Ignored is the projection that FICA taxes would continue to fund 79% of benefits even if the current $3 trillion trust fund was depleted.

Most tragic projections come from folks like Senator Willard Mitt Romney, a slippery, former hedge fund manager (Bain Capital). Those scolds want all your Social Security retirement contributions invested with their salivating banker buddies.

You can’t blame the finance folks (already devouring 40% of our GDP) acting like characters in Animal Farm.

Privatization pigs will never be satisfied until they can gobble up more profits by replacing everything we now call public, including America’s universal pension system.

Social Security’s most belligerent haters tell us the fund needs an immense infusion of funds to remain solvent, and using odd predictions have arrived at their own idea of that total:

$40 trillion ($40,000,000,000,000) over 75 years.

The suidea (pigs) have many solutions – in addition to ending the program by privatizing.

President Barack Obama answered their oinks early in his first term, when he enacted a disgrace named the Simpson-Bowles Commission. That group of political appointees then merrily recommended some 92% of seniors should have their earned pension benefits cut.

That effort failed, but just this year the Senate is chomping on a similar idea promoted by Romney – the Trust Act (click link for more details).

Co-sponsors include: Sen. Joe Manchin, III [D-WV], Sen. Todd Young [R-IN], Sen. Kyrsten Sinema [D-AZ], Sen. Shelley Moore Capito [R-WV], Sen. Angus S. King, Jr. [I-ME], Sen. Rob Portman [R-OH], Sen. Mark R. Warner [D-VA], Sen. John Cornyn [R-TX], Sen. Mike Rounds [R-SD], Sen. Kevin Cramer [R-ND], Sen. Cynthia M. Lummis [R-WY], Sen. Dan Sullivan [R-AK], and Sen. Bill Cassidy [R-LA].

The House of Representatives also has its own bill claiming to “strengthen” Social Security, which further perverts the program into a welfare “equity” effort. (Under current rules the more FICA you pay the lower the percentage of prior earnings are your retirement benefits.)

Are radical political/corporate changes necessary?

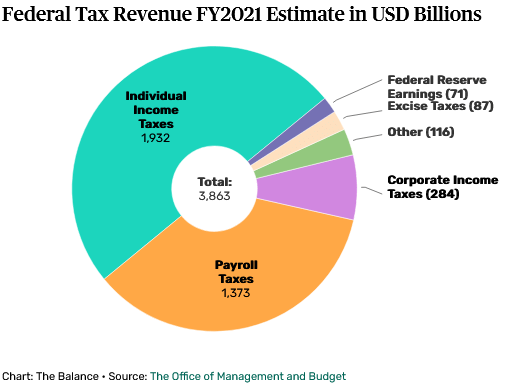

The U.S. government’s total revenue was estimated at $3.863 trillion for FY 2021. Some $200 billion was for disability insurance paid for by workers and their employers. Another $1,073 trillion went to retirees. Combined they accounted for the $1,373 trillion of FICA (payroll) taxes.

Why, you might wonder, are only the workers of America paying for disabled citizens – the blind, paralyzed and even, surprisingly, ADHD children and adults?

For example, here are the actual Social Security rules for receiving just one type of monthly disability payment:

Applying for SSDI for ADHD for Children or Adults

You must meet the specific limitation levels as listed by the SSA for both Para A and Para B below:

Para A

-

- Marked or severe hyperactivity

- Marked or severe inattention

- Marked or severe impulsiveness

Para B

You must be able to show medical evidence that you undergo the following symptoms:

-

- Marked or severe impairment in age-appropriate cognitive/communication function; and/or

- Marked or severe impairment in age-appropriate social functioning; and/or

- Marked or severe impairment in age-appropriate personal functioning.

If you or a loved one with ADHD meets the above requirements then you may apply for disability benefits for ADHD directly from the SSA website, or meet our disability advocates to guide you with step-by-step procedure to increase your chances of winning disability for ADHD.

Loose requirements, like the above, also obviously invite fraud. How many children with bad behavior do you know who might qualify? Exaggerated claims are tempting, since some disabled applicants can receive more than $3,000 monthly.

Since disabled workers and their children constitute about 20% of Social Security’s benefits ($200 billion annual FICA taxes), the simple solution to insuring Social Security’s future is moving some or all of the disability payments fund to the government’s general fund.

Under the present system only the working class and their employers are supporting the disabled, but shouldn’t that responsibility fall on everyone?

Currently, disability taxes on workers of $200 billion are almost comparable to all corporate taxes at $284 billion. Among others, why not have our corporations share in aiding the disabled?

Moguls who live on capital gains pay no taxes for Social Security, including funds for disability. Why are they exempt from contributing to the general welfare?

It appears that the 1956 decision to subvert Social Security by adding disability to its burden was just a scam to make workers foot the bill with no responsibility by anyone else.

Remember the above $4 trillion deficit scare number of 75 years.

If we transfer the worker’s portion of the Social Security FICA Disability tax (.9%) to the retirement fund, and move that disability burden to the federal government general fund, the savings – even without interest earned by the fund – will accrue to nearly $7.5 trillion in the “experts'”designated 75-year period.

That is $3.5 billion more than the projection of the retirement fund’s deficit.

Employers would continue to be responsible for their .9% share of the 1.8% total disability tax.

Sounds fair. A win for everyone, except those nasty porkers.